Synthetic Products Enterprises Limited Report for Fiscal Year 2023

This report offers a detailed snapshot of the macroeconomic conditions, industry and company highlights of Synthetic Products Enterprises Limited (SPEL).

Disclaimer: The article below is the work of a participant of Fundamentals of Capital Market training. Sarmaaya.pk holds no liability for the recommendation mentioned.

Synthetic Products Enterprises Limited (SPEL) is one of the leading B2B manufacturing plastic products and packaging company listed on Pakistan Stock Exchange (PSX). It is a part of the KSE100 Index. This report includes a detailed analysis of the company. The report also includes Pakistan's country profile, its business overview, and a detailed financial, business, and management analysis. Through a thorough examination of these factors, the aim of this report is to provide investors with a holistic understanding of the company's market position and investment worthiness.

In a Nutshell

Analyst Background:

This report is conducted by Ejaz Khaliq, a participant in the Fundamentals of Capital Market (Batch 6), Batch 6 by Ammar Yaseen. Ejaz is a civil servant by profession with a master's degree in history. He doesn't have any previous background in finance and investing. Now, however, after 12 weeks of training. He is well-equipped to handle any financial analysis task.

Macroeconomic Profile:

Inflation: PositiveDuring the month of December 23, inflation edged up to 29.66%, a slight increase from 29.23% in November, driven by escalating gas prices. A significant reduction in inflation is, however, anticipated, projecting it to fall below 20% by June 2024.

Interest Rates: PositiveThe Monetary Policy Committee of the State Bank of Pakistan reasserted an optimistic view. The MPC reaffirmed its projection of a sustained decline in inflation and opted to maintain the status quo by retaining the policy rate at 22% for the time being.

Oil Prices: PositiveIn December 2023, oil prices experienced fluctuations due to increased U.S. supply and strong non-OPEC+ production, alongside a slowdown in global oil demand growth. The prices of Brent, Arab Light and WTI plummeted by 16.59%, 16.77%, and 17.28% YoY, respectively during CY23. Oil prices are anticipated to average around USD 85/bbl in FY24, USD 75.00/bbl in FY25.

Currency Valuation: PositiveIn the initial half of CY23, the PKR experienced a depreciation of 20.83% against the dollar. However, in the latter half of the year the PKR appreciated against the USD. IMF program requires to maintain a market- determined exchange rate. Pakistan Real Effective Exchange Rate (REER) was 98.2 in Nov 2023.

Current Account: PositiveThe Current Account turned from a deficit of USD 157mn to a surplus of USD 9mn in November 2023. The key factors contributing to this improvement were a 12% surge in total exports, combined with a mere 6% increase in overall imports. Additionally, remittances witnessed a 4% YoY increase in November 2023. The favorable trend of the current account balance is expected to persist throughout the remainder of FY24. It is anticipated that in FY24 the current account deficit will remain within the confines of 1.5% of GDP.

Fiscal Account: PositiveFBR continued its streak of surpassing target in the month of December by collecting PKR 984 billion taking 6MFY24 total collection to PKR 4,468b against the IMF’s indicative target of PKR 4,425b outlined in the SBA. Revenue measures taken by the government have notably bolstered domestic revenue generation. The fiscal deficit as a percentage of GDP is anticipated to be at 7.5% in FY24 (projected to decrease to 6.8% in FY25F), compared to 7.7% in FY23.

Central Bank Reserves: PositiveDuring December 2023 SBP’s foreign exchange reserves saw an increase of around USD 800 million to reach USD 7.8 billion on the back of flows from multilateral sources. Pakistan is also set to receive an additional USD 700 million from IMF in January 2024 after successfully completing the staff level review. The overall reserve position is expected to improve (SBP reserves: USD 10bn expected by Jun’24)

IMF & Political Stability: PositiveThe culmination of IMF’s SBA signed towards the end of Jun-23 infused renewed confidence among investors which was further supported by emerging clarity on the political front. Pakistan is on the verge of completing its SBA and immediately will be required to enter an EFF with the IMF. In the forthcoming election, there is an anticipation of a coalition government emerging as a catalyst for political stability. The continuation of Pakistan's engagement with the IMF coupled with political stability is imperative for the country to navigate its economic challenges.

Company Profile:

SPEL is a manufacturing company which has B2B relations with most of its customers. It is principally engaged in the manufacturing and sale of plastic packaging for the food & FMCG industry, plastic parts for the automotive industry, and molds & dies. The products of SPEL can broadly be categorized into the following sectors:

Food and Personal Care Products Sector – PackagingThe major products for food industry include 19-liter water bottles, yogurt cups, ice-cream tubs, plastic glasses, disposable containers etc. The customers in this sector include Nestle, Unilever, Pepsi, KFC, Baskin Robbins, Subway, Qarshi Industries, Sufi, Gourmet, Cakes & Bakes, Doce Foods, etc.

The products for FMCG industry include shampoo bottles, packaging for detergents, caps for skincare products, etc. and the customers in this sector include Unilever, Colgate Palmolive, Pakistan Tobacco Company, etc

Automobile Parts & Accessories SectorMajor customers of the company in the automotive sector include Indus Motors, Honda, Suzuki, Millat Tractors etc. The auto parts that are being supplied by the Company include door trims, door handles, garnishes, grills, steering wheels, etc.

Products:

SPEL also exports components for off road vehicles including Steering Wheels, Steering Columns and Steering Knobs to Distributors, OEM suppliers and Assemblers of Agricultural Machinery, Construction Machinery, Grass Cutting Machinery, Tractors, Forklift Trucks, Cranes, Earth Moving Equipment, Golf Carts, Cleaning Machinery, Airport Vehicles in the EU, Europe and USA. SPEL also exports food packaging products to Al-Marai and KFC in the Middle East

Financial Analysis:

Growth Factors:

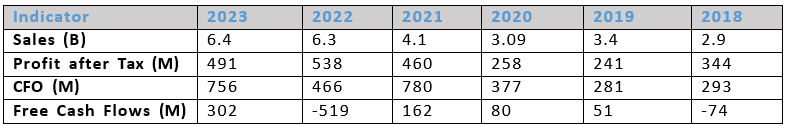

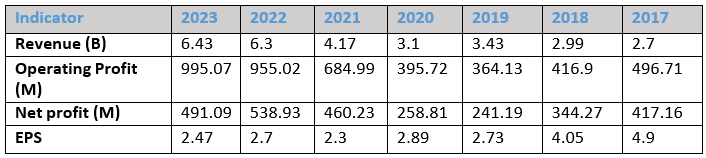

The revenue and profits of the company show a consistent positive trend. Net profit in the preceding year declined despite good sales because of the high cost of finance, PKR depreciation and imposition of super tax. EPS is continuously positive.

Stability Factors:

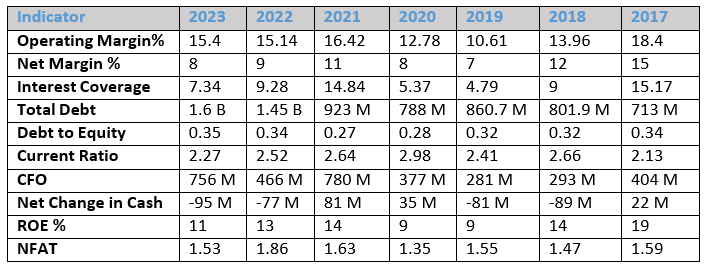

The company is continuously profitable, but its total debt is increasing, which is bad. However, debt to equity ratio is good. Cash flow from operations is consistently positive, which is good. Return on Equity is positive but not optimal. Net change in cash reflects CAPEX, which is good for the future of the company.

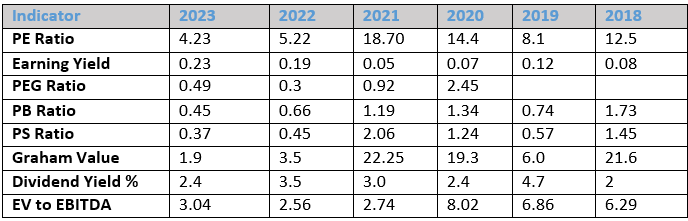

Valuation Factors:

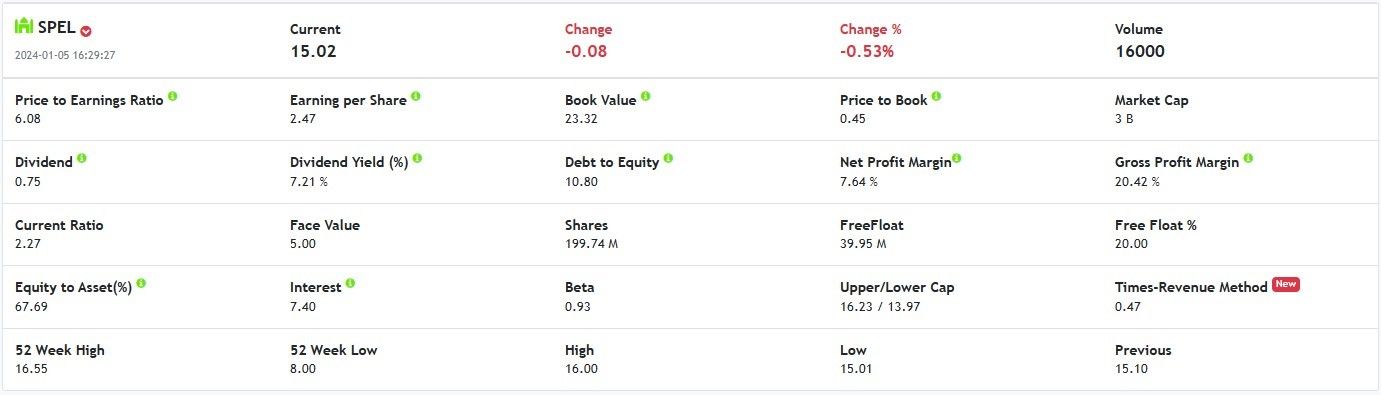

All of the Valuation Indicators reflect that the company is available at a very attractive price to buy.

Business and Management Analysis:

Business Factors:

SPEL operates as a consistently profitable organization. It has managed to maintain its sales and profits because of strong demand from FMCG sector despite being heavily dependent on imported raw materials (only 20% of materials that are sourced locally). The profit after tax has shown a decline because of imposition of 10 % super tax and high financing cost. An amount of Rs 604 million has been invested in CAPEX. By investing in renewable energy sources, the company has been able to reduce energy cost by 10% this past year alone.

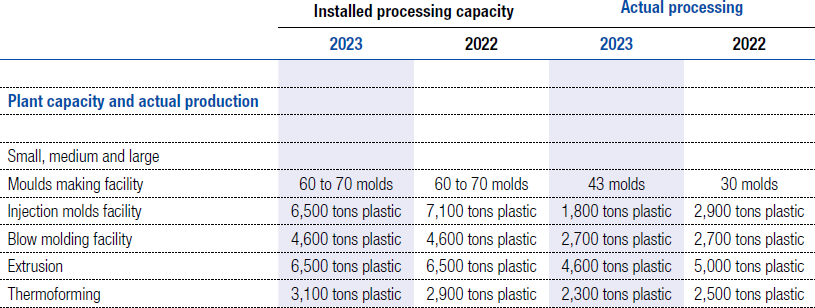

A comparison of installed capacity and actual processing below reflects the underutilisation of installed capacity in the preceding 2 years because of very sloe demand from Auto Industry owing to Dollar/PKR instability and economic situation of Pakistan. However, it also reflects that the company has the capacity to fulfil its obligations if the economy turns around and demand increases or exports pick up.

Management Factors:

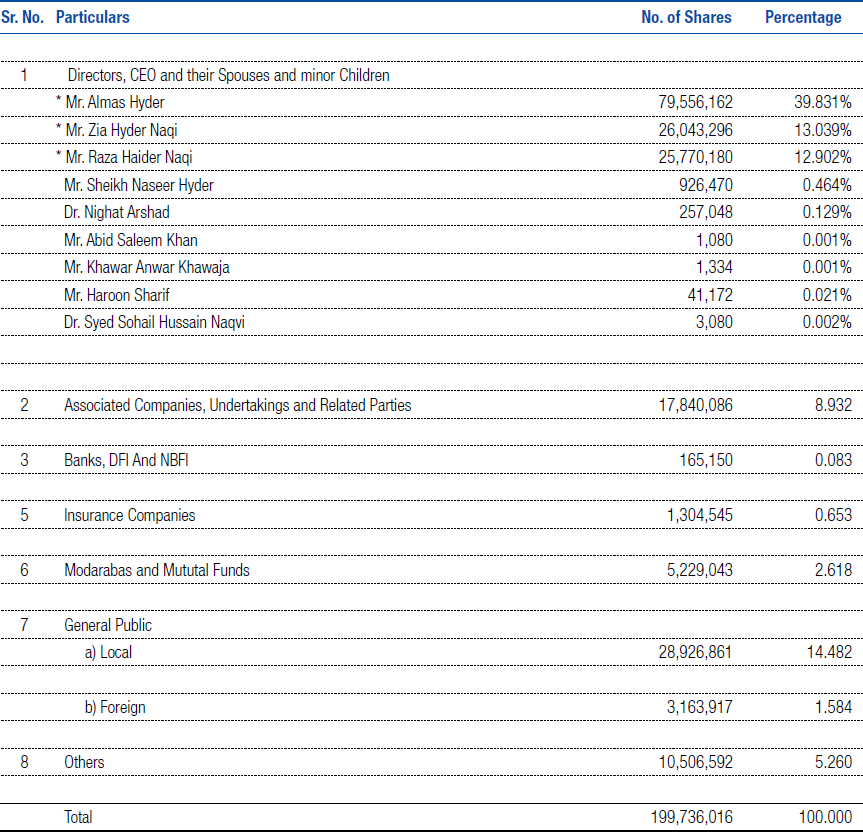

The composition of the board reflects that the company is being operated by a professional team.

The pattern of shareholding reflects that the management has strong belief in the company. However, it also reflects that there is negligible institutional investment in the company. Only 20 % of the company’s share is in free float.

The company is buying back its shares and as on 02 September 2023, it has purchased 6,474,500 ordinary shares which shows the confidence of management in the company.

Strength and Weakness

Strengths:

- SPEL enjoys a very selective client base, both in domestic and international markets.

- The company can pass on its costs because of forex fluctuations owing to B2B nature and arrangement of its business.

- The competition in the market is low because of specialized products and the huge investment requirement for new entrants.

Weaknesses:

- Heavy reliance on imported raw material because of which the company is susceptible to forex fluctuations.

- Regulatory changes in terms of usage of plastics and environmental compliances by the government can affect profitability of the company.

- Because of B2B nature of the business, the profitability of the company is heavily dependent on the partner businesses for example demand from Auto industry has significantly diminished in preceding years because of economic conditions.

Summary

SPEL is a profitable company and has strong B2B business. Although it is heavily dependent on imported raw material but because of its special B2B arrangement of business it can pass on any of its costs because of forex fluctuations. Because of this reason it has remained profitable in tumultuous economic conditions. It has a persistent demand from FMCG market and as the economy turns around demand from auto sector will also pick up. The company is also trying to increase its exports. Because of its unique positioning in the industry, specialized production and long-term, strong B2B ties, it is expected to remain profitable in future. As inflation and interest rates subside the company is further expected to gain as demand from its B2B partners will increase. The management is holding the majority of its stock and further buying it back, which shows their confidence in the company. However, because of small free float, the stock may not be suitable for frequent buying and selling.

References:

- Sarmaaya.pk

- Investing.com

- AHL Research

- SPEL Annual Report 2023

- PSX data portal