Power Cement Limited Report for Fiscal Year 2023

This report offers a detailed snapshot of the macroeconomic conditions, industry and company highlights of Power Cement Limited (POWER).

Disclaimer: The article below is the work of a participant of Fundamentals of Capital Market training. Sarmaaya.pk holds no liability for the recommendation mentioned.

Power Cement is one of the leading companies from the Cement sector on Pakistan Stock Exchange (PSX). It is a part of the KSE100 Index.This report includes a detailed analysis of the company. The report also includes Pakistan's country profile, its business overview, and a detailed financial, business, and management analysis. Through a thorough examination of these factors, the aim of this report is to provide investors with a holistic understanding of the company's market position and investment worthiness.

In a Nutshell

Analyst Background:

This report was conducted by Sanaan Haider, a participant in the Fundamentals of Capital Market Batch 6 by Ammar Yaseen. He did his postgraduate degree from the University of Sydney in International Management CEMS and exchange from the University of Cologne. He's been managing his family business of Pharmaceutical Manufacturing after coming back to Pakistan as Director of Operations and Supply Chain. Now after 12 weeks of training, he is well-equipped to handle any financial analysis tasks.

Macroeconomic Profile:

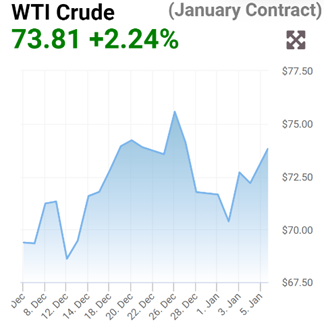

In FY23, Pakistan encountered various economic challenges; however, as we entered the HY24 period, there seems to be a positive shift after hitting a low point around June '23. Given Pakistan's reliance on imports, the decline in oil prices has alleviated pressure on the country's reserves and current account. The interest rates, although currently at 22%, are expected to gradually decrease by the end of FY24.

Stringent regulations on exchange companies, coupled with an incremental improvement in exports, have contributed to a relatively stable PKR/USD exchange rate in the past month. While Consumer Price Index (CPI) inflation remains high, there is a slight decrease in food inflation, with overall inflation figures largely influenced by rising gas and electricity prices.

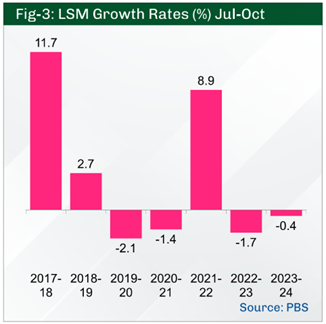

In terms of economic indicators, Large Scale Manufacturing (LSM) saw a decline of 0.4 percent during Jul-Oct FY 2024, an improvement compared to the 1.7 percent contraction in the same period last year.

Company Profile:

Power Cement Limited was founded in 1981 with its factory site being located at motorway M9, Nooriabad, Sindh, strategically ideal location for the cement factory. Previously known as Al-Abbas Cement Limited until it's acquisition in 2010 by the Arif Habib Group, a prominent financial and industrial conglomerate.

The company excels in producing and selling high-quality cement. It has a robust market presence in Southern Pakistan and exports clinker and cement to various international destinations like the Middle East, Sri Lanka, and East African countries.

The company boasts a nameplate clinker production capacity of 10,700 Tons Per Day (TPD), translating to an annual 3.21 million tons. Additionally, it has an annual cement production capacity of 3.37 million tons (11,235 TPD), solidifying its regional leadership.

The company strategically invested in a state-of-the-art European plant from FLSmidth, a leading manufacturer. Integrated seamlessly in recent years, this modern facility underscores the company’s commitment to boosting production capacity and upholding global standards.

The company has 505 employees and a network of 250+ dealers and distributors across Pakistan.

Financial Analysis:

Growth Factors:

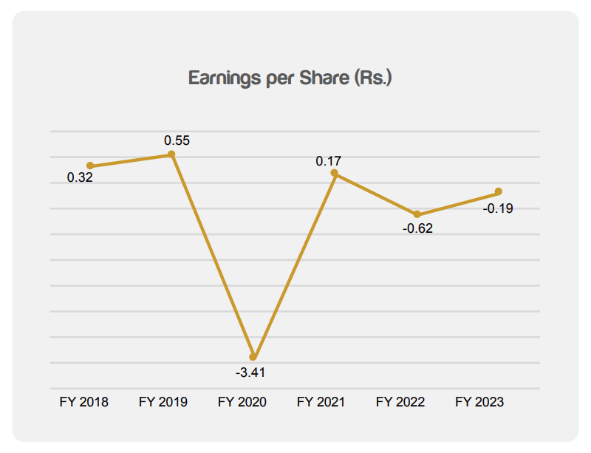

The organization has shown notable expansion in sales over the past five years, boasting a Compound Annual Growth Rate (CAGR) of approximately 49% in net sales and 47% in gross profit. However, there has been a significant reduction in net income. This decline can be attributed to the persistently high interest rates in recent years, resulting in elevated finance charges due to the company's considerable leverage which clocked in a 45% increase YoY at 3.81 Bn. The reported loss amounts to -0.19 per share, reflecting the adverse impact of subpar net income figures over the last five years.

Stability Factors:

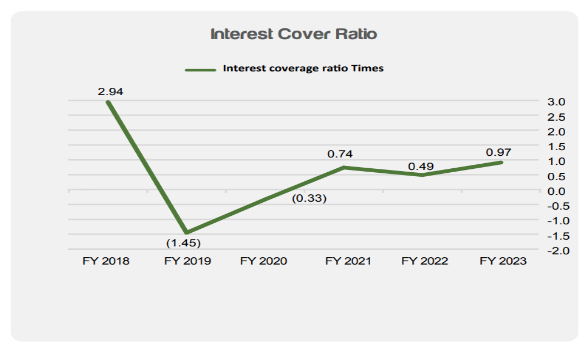

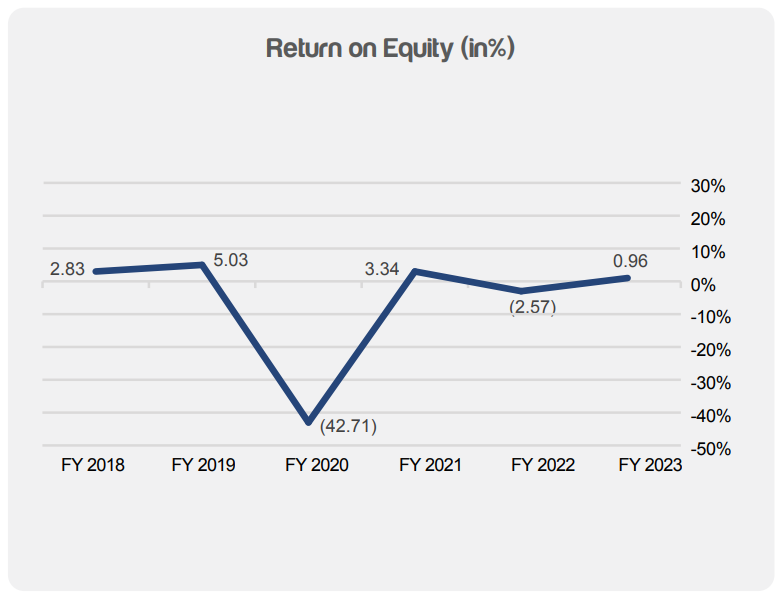

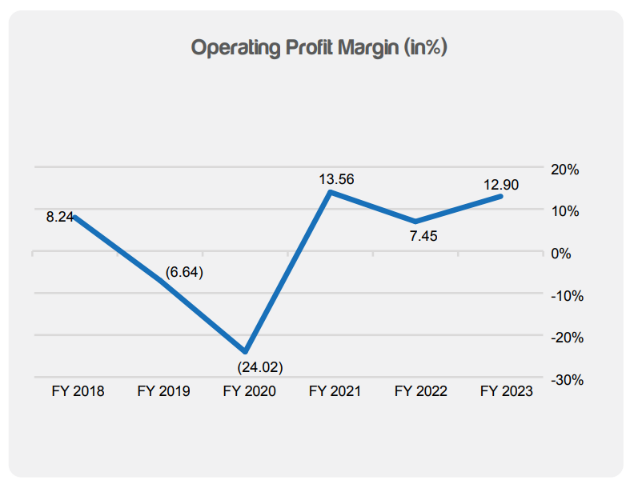

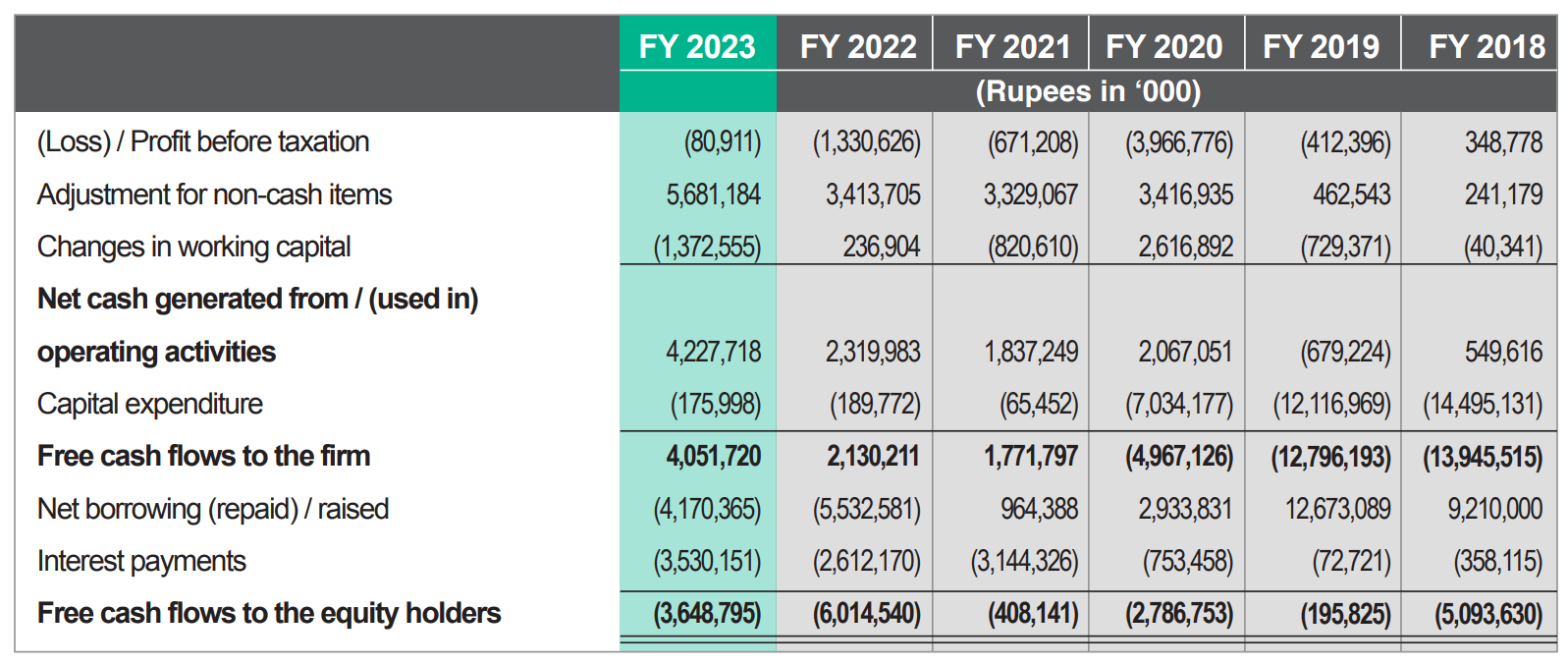

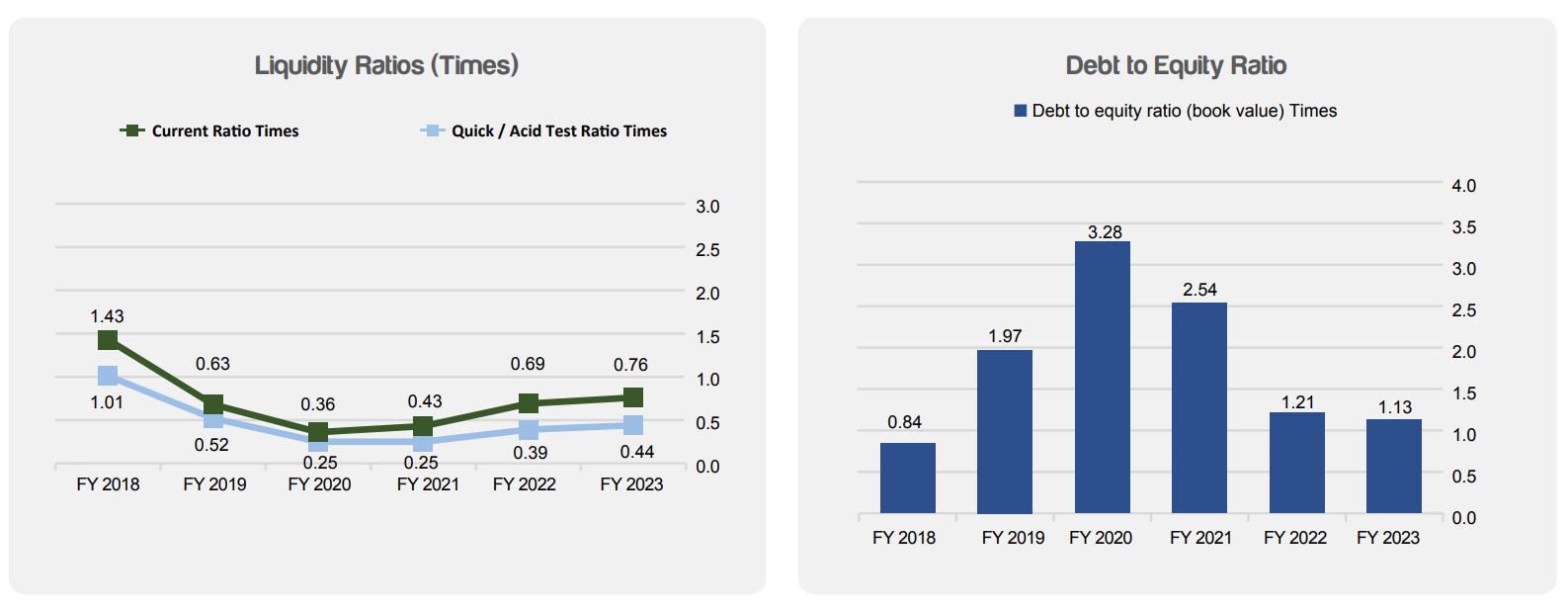

The company has faced challenges due to increasing interest payments, leading to a decline in net profit margins. Operating profit margins have also been unstable due to the depreciation of the PKR and rising costs of goods sold (COGS). The interest coverage is at 0.97, compared to 0.49 in the same period last year. The total debt has risen to 32 billion, resulting in a debt-to-equity ratio of 1.13. The current ratio is a modest 0.76, accompanied by negative cash flow from operations and an overall negative cumulative profit after tax (PAT). Return on equity stands at 0.96, an improvement from last year's figure of -2.57. These indicators suggest that the company is grappling with declining cash flow and substantial debt, negatively impacting its earnings.

Valuation Factors:

The company's Price-to-Earnings (PE) ratio is at -21.73, and the Price-to-Book (PB) ratio is 0.32. Despite the share's low market price of 4.10 per share, it is considered affordable mainly due to a decline in earnings rather than the inherent value of the share. Over the past 5 years, the company has not issued dividends, conducted share buybacks, or distributed bonus shares. This lack of shareholder distributions could be a notable factor contributing to the lower valuation metrics.

Free Cash flows:

The data indicates that the company achieved its highest free cash flow to the firm in FY 2023, attributed to enhanced gross margin and operating profit margin. However, this positive cash flow transformed into negative free cash flows for equity holders due to principal debt repayments and the associated finance costs. Free cashflows per sale and cash to debt ratio are in a bad position which is a worrying sign for the company’s future cashflows.

Business and Management Analysis:

Business Factors:

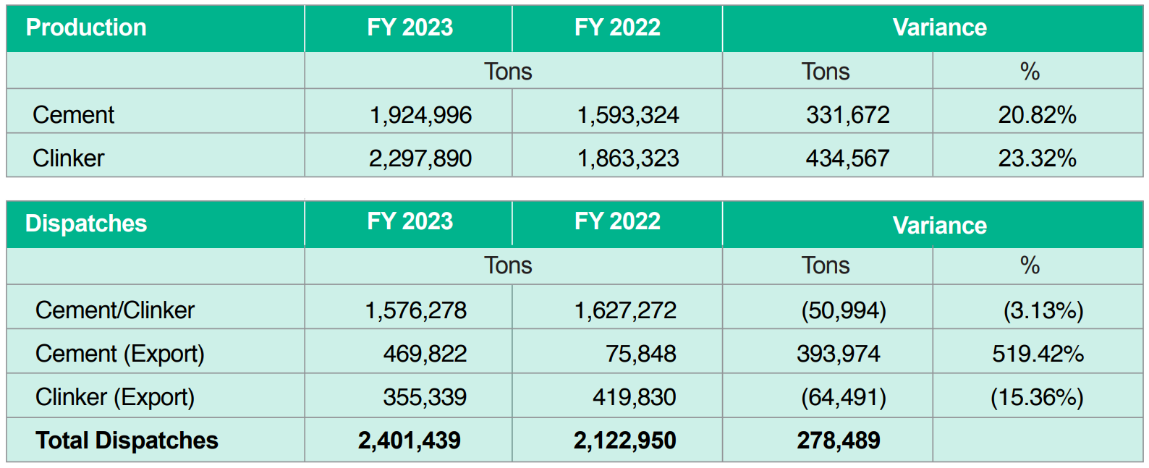

In FY-2023, Power Cement Limited experienced a notable surge in net sales revenue, up by 65% from FY-2022. Local sales rose by Rs. 5.65 billion (39%), and exports increased by Rs. 5.79 billion (185%). The company's gross profit saw an impressive 177% growth, with the gross profit margin improving from 14% to 24%. This enhancement was driven by better retention prices and effective cost management, particularly in reducing fuel and electricity costs.

However, finance costs rose sharply by 45%, reaching Rs. 3.81 billion, primarily due to an unprecedented increase in interest rates. This contributed to a loss before tax, resulting in a Loss Per Share (LPS) of Re. 0.19 for the fiscal year.

In the reviewed year, the company produced 2,297,890 tons of clinker, achieving a capacity utilization of 72%. This marks a significant increase compared to the previous year when clinker production was 1,863,323 tons, resulting in a capacity utilization of 58%.

Management Factors:

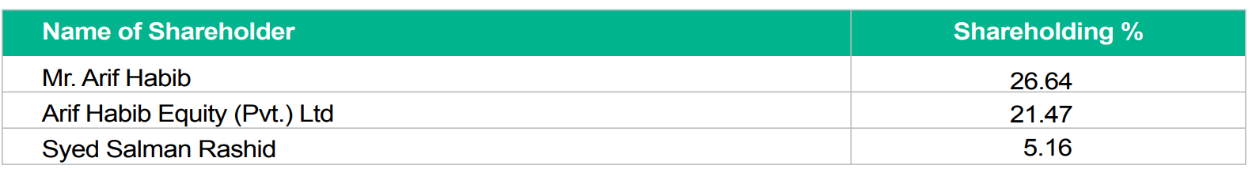

The company’s majorly held shares are mentioned below: 389 million free float shares are available in the market which are 35% of total shares. The shares of the company are held by 6 modarbas or mutual funds which are 0.31% of total shares.

Strength and Weakness

Strengths:

- Production Capacity:The company is acknowledged as one of the largest cement producers in the South Zone, with a strong and robust production infrastructure.

- Certifications & Standards:The company holds exclusive certification for 53 Grade cement in the South Zone and adheres to environmental standards set by IFC/World Bank/EU and SEPA, demonstrating its commitment to quality and sustainability.

- Strategic Location:Proximity to seaports ensures efficient logistics and distribution.

- Innovative Energy Solutions:With projects like the Waste Heat Recovery System and renewable energy initiatives, the company emphasizes eco-friendly and cost-efficient energy solutions.

Weaknesses:

- Transport Dependency: The company's reliance on external transporters, due to the absence of an in-house fleet, poses a potential risk to timely deliveries.

- Financial Strain: The company's high gearing levels and resulting elevated financial costs are exerting pressure on its financial health.

- Liquncerns:The company's liquidity position seems challenged, as indicated by a current ratio (current assets/current liabilities) of less than 1 in 2023, suggesting potential difficulty in meeting short-term obligations without raising additional capital or liquidating assets.

- Earnings Pressure: Subdued Earnings Per Share (EPS) due to factors like low PAT and high interest rates.

Summary

The company faced a challenging year amid widespread inflation and elevated interest rates, impacting both demand and significantly increasing the company's debt obligations. The current high leverage is a concern, and until there's a substantial reduction in interest payments, it is likely to continue negatively affecting earnings and cash flows.

Given these circumstances, I would advise against purchasing the company's shares until it begins to alleviate its debt burden and demonstrates consistent sales performance in the future.