Dewan Cement Limited Report for Fiscal Year 2023

This report offers a detailed snapshot of the macroeconomic conditions, industry and company highlights of Dewan Cement Limited (DCL)

Disclaimer: The article below is the work of a participant of Fundamentals of Capital Market training.Sarmaaya.pk holds no liability for the recommendation mentioned.

Dewan Cement Limited is one of the leading companies from the Cement sector on Pakistan Stock Exchange (PSX). It is a part of the KSE100 Index. This report includes a detailed analysis of the company. The report also includes Pakistan's country profile, its business overview, and a detailed financial, business, and management analysis. Through a thorough examination of these factors, the aim of this report is to provide investors with a holistic understanding of the company's market position and investment worthiness.

In a Nutshell

Analyst Background:

This research is conducted by Mohsin Shekhani, a participant in Fundamentals of Capital Market, Batch 7 by Ammar Yaseen. Mr. Mohsin is a director at Culligan Water Pakistan-Karachi. He has no prior knowledge of stock analysis but after 12 weeks of training, he is well-equipped to conduct any sort of research and analyze any stock in detail.

Macroeconomic Profile:

Pakistani rupee has been stable since the new government has taken over. This is positive for Dewan Cement limited. Economic growth is slowly showing signs of growth.

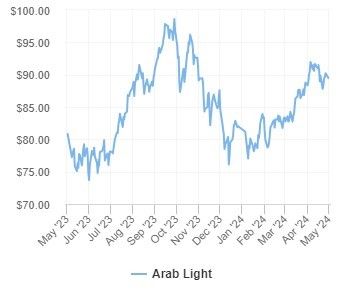

Arab light Oil has been hovering around $80-$90. These needs to be monitored as it can have adverse impact if the prices start going up due to uncertainty in middle eastern region.

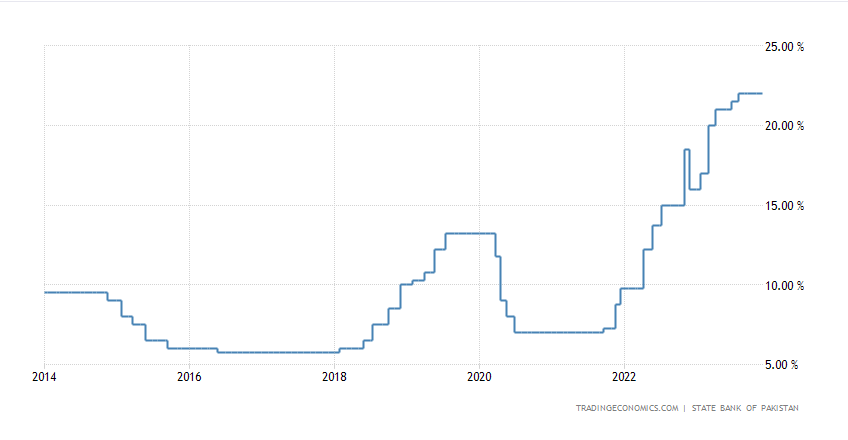

SBP has kept the interest rate in Pakistan unchanged at 22% in the latest monetary policy meeting. However, it did note that macroeconomic stabilization measures are contributing to considerable improvement in both inflation and external position. We could expect a rate cut by second half of 2024.

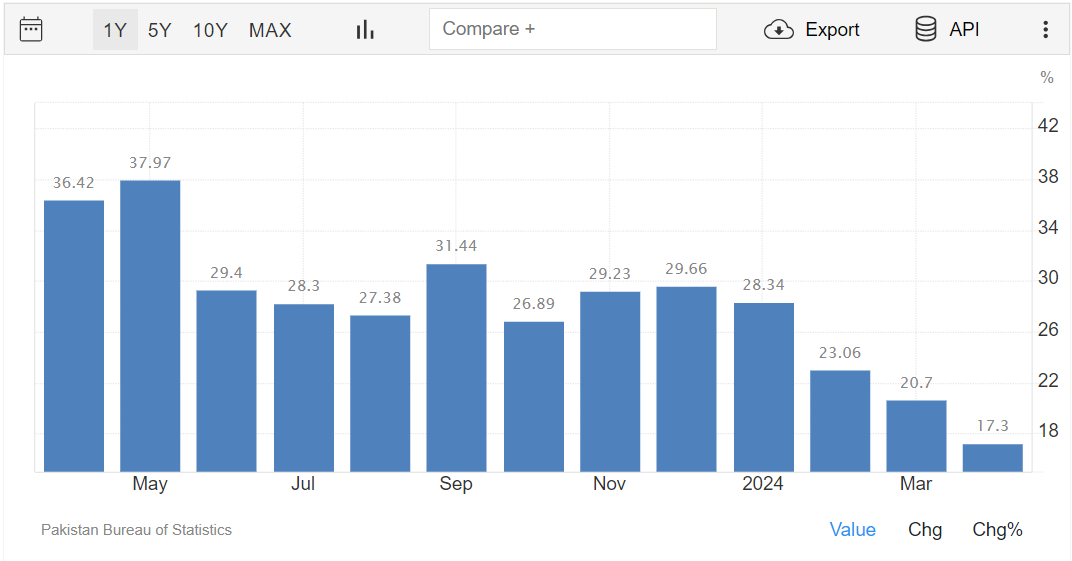

Inflation rate in Pakistan has also started reducing and currently stands at 17.3 as of April 2024. With macroeconomic measures improving. Inflation is further expected to come down. SBP has set a target range of 5-7% by September 2025. With inflationary pressures declining dewan cement should be able to increase production.

Current account has also posted a surplus $619 million in March 2024 this will impact the economy positively and will also give confidence to investors.

Pakistan posted a fiscal surplus of Rs. 1834.0 billion during Jul-Feb FY 2024. Net federal reserves also witnessed a 51% growth due to growth in both tax and non-tax collection.

Large Scale Manufacturing has observed a marginal decline of 0.5% during Jul-Feb FY 2024 against a contraction of 4.0% last year.

Pakistan’s forex reserves increased to $13.3 billion on April 25, 2024, with SBP’s reserves at 8.0 billion and commercial bank reserves remained at $5.3billion. Forex reserves have slowly been increasing as well with last IMF SBA programme tranche also approved.

Overall, there has been moderate improvement in all the above factors which have started to look positive for Pakistan and for the investors.

Company Profile:

Dewan Cement Limited (DCL) was initially called Pakland cement which came into being 1980 as public limited company but due to inappropriate control measures, strategic blunders Pakland cement was acquired by another business magnate in 2004. It became part of Yousuf Dewan group of companies in 2004 and was renamed to Dewan Cement Limited.

Dewan Cement has a capacity of more than 2,880,000 tons per annum from two manufacturing units, comprising Pakland Cement Ltd., and Saadi Cement Ltd. Yousuf Dewan ventured into cement business in 2004 by acquiring Pakland Cement Ltd., and Saadi Cement and renaming it to Dewan Cement Limited.

The company has two production facilities; one in southern part of the country near Karachi at Deh Dhando, Dhabeji, Sindh and second is northern Pakistan near Kamlipur Hattar Industrial Estate. Both the plants provide a distinct advantage. The northern plant covers the Punjab and KPK area in local market along with India and Afghanistan in the international market. The southern plant covers Sindh and Balochistan local market and with proximity to port it exports to markets of Sri Lanka, Africa and Middle east.

Company’s dispatches experienced a decline of 12.63% as compared to previous year. This decline was due to mixture of factors such as political uncertainty, higher inflation, raised interest rates and exorbitantly inflated power prices. While at the same time exchange control measures implemented by State Bank of Pakistan also led to uncertainty and increase in USD rates which had direct impact dewan cement as a result it led to increase in prices of fuel, coal, and other materials.

The cement sector is facing a precarious situation with multiple risk factors such as devaluation of Pakistani Rupee against the US dollar, high inflation affecting the purchasing power of public as well increased tax measures.

Main competitors of Dewan cement are Kohat cement, Lucky Cement, Pioneer Cement, Bestway Cement, Fauji Cement limited. A comparison of performance of all companies has in PSX is given here. Dewan cement has been lagging all the other cement companies in terms of performance in PSX.

Dewan cement has also faced significant pressure due to exchange rate restrictions and devaluation of the rupee.

Financial Analysis:

Growth Factors:

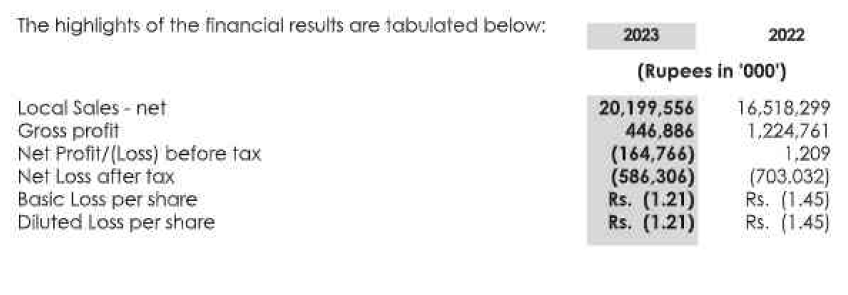

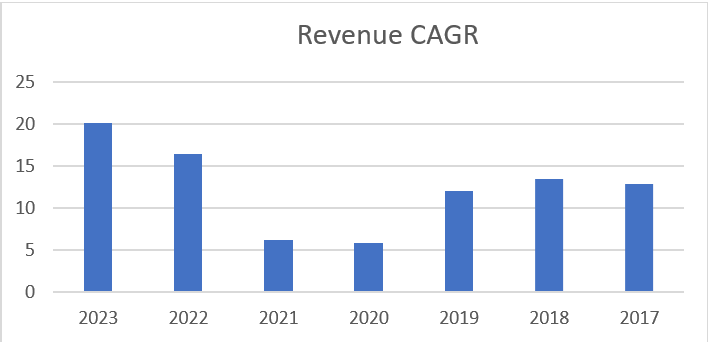

DCL’s revenue has grown to 20.2 B in FY 2023 as compared to 16.52B in FY 2022. Operating profit has been declining since 2020. Net Income has improved to -586.31M in 2023 from -703.03 M in 2022 but still in negative which means that profits have been declining over time. Overall, the growth has been averaging since there was not much growth in 2021 and 2020.

The EPS of the company is also in negative although it has decreased from -1.45 in 2022 to -1.21 in 2023 but is losing money. The company is not growing since it has been unable to pay its lenders due to liquidity problems.

Stability Factors:

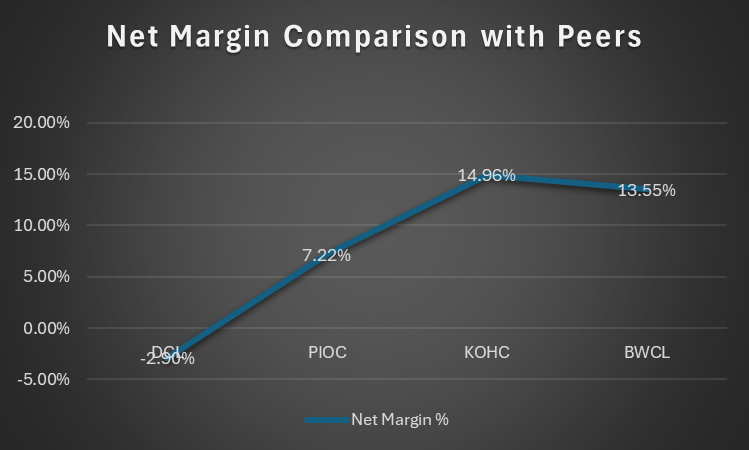

DCL Net Margin is -2.90% for 2023 compared to -4.26% for 2022. This is bad in comparison to its peers namely KOHC, PIOC & BWCL net margin figures are also the lowest amongst all the other companies.

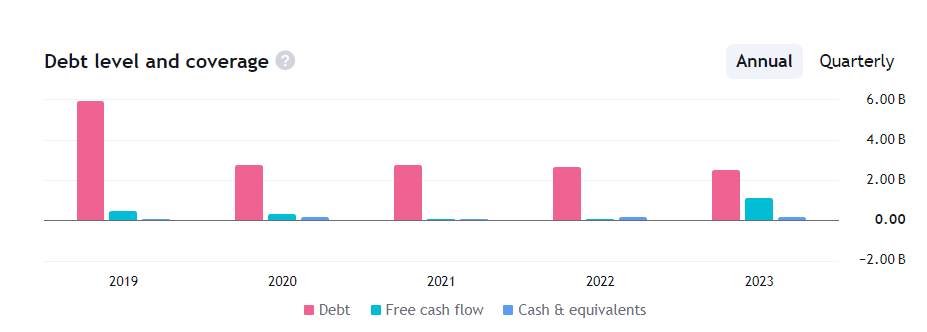

DCL also has cashflow issues since it is not able to generate sufficient earnings in order to pay for the interest. DCL’s interest coverage currently stands at -5.87 times, which is considered to be bad. It has more liability than assets. As of June 30, 2023, current liabilities exceed its current assets by Rs. 3,195,785 million. It can also be seen from the current ratio which is at 0.58 and also from Total debt which is higher. The company has more debt than assets and also is not able to make timely payments for the loan.

There has been a cash inflow of 1.19B for DCL in 2023 but overall, its net change in cash is negative at -72.97M meaning that company would have would used the cash to pay down its debts. Having a ROE of greater is considered to be good for the company, DCL’s ROE has been in negative consistently for the last 5 years. DCL is having issues maintaining its profit along with equity.

Overall stability-wise DCL is not doing good with loans increasing and not being able to generate profits company is having issues. Even when compared to its peers the valuation of the company is not good.

Valuation Factors:

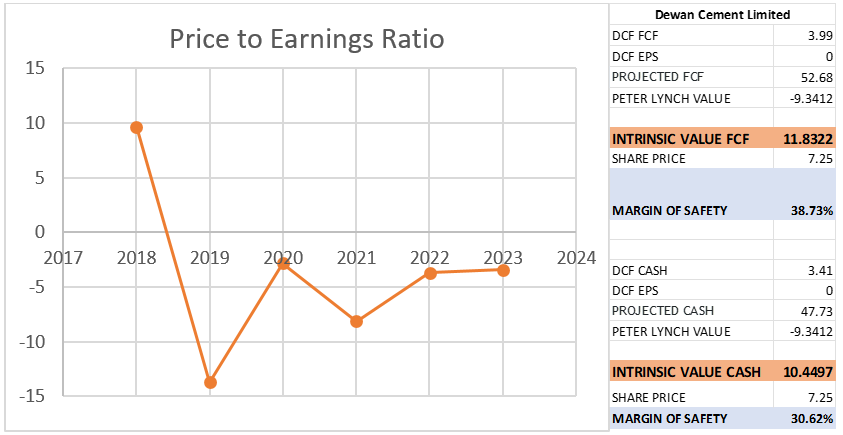

DCL’s PE ratio is -3.43 while the earnings yield is -0.29 which means that the company is not doing well and is losing money. The last dividend announced by the company was in 2006 after that the company has not been paying dividends. The intrinsic value of the FCF is 11.83 with 38.73% margin of safety, Intrinsic value cash is 10.45 with 30.62% margin of safety. Compared to its peers the margin of safety is very low.

Business and Management Analysis:

Business Factors:

Dewan Cement Limited manufactures and sells cement. The company provides ordinary Portland, sulphate resistant and rapid setting cement products. It was incorporated in 1980 and is based in Karachi. DCL is one of the Pakistan’s largest manufacturers with annual capacity of 2.9 million tons.

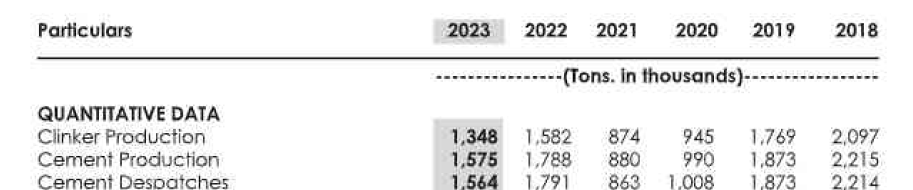

There has been an increase in local sales of about 22% from the previous year whereas, a decline was witnessed in the dispatches from 1,790,543 tons to 1,564,390 in 2023. The gross profit margin has decreased from 7.41% to 2.21% as compared to last year. This was primarily due to periodic shutdown of machinery for maintenance, significant increases in cost of coal, power, and transportation along with higher inflation. Management is trying to mitigate the higher cost by improving plant efficiency.

Clinker Production, Cement Production and Cement dispatches all three have declined YoY. Dewan Cement has not been able to pay dividends since 2006. It has a lot of debt and liabilities outstanding. In the last 5 years debt has been increasing and currently stands at 11.16B, also company does not have cash in hand which could create further problems going forward as pointed out by the auditors in 2023 annual report. The company’s current liabilities exceed its current assets, and the auditors believe that it would be a going concern for the company as they might not be able to realize its assets and discharge its liabilities in the normal cause of business. Total liabilities have increased by 20% from 18.28B to 22.06B. Overall Dewan Cement limited is not doing well financially.

Management Factors:

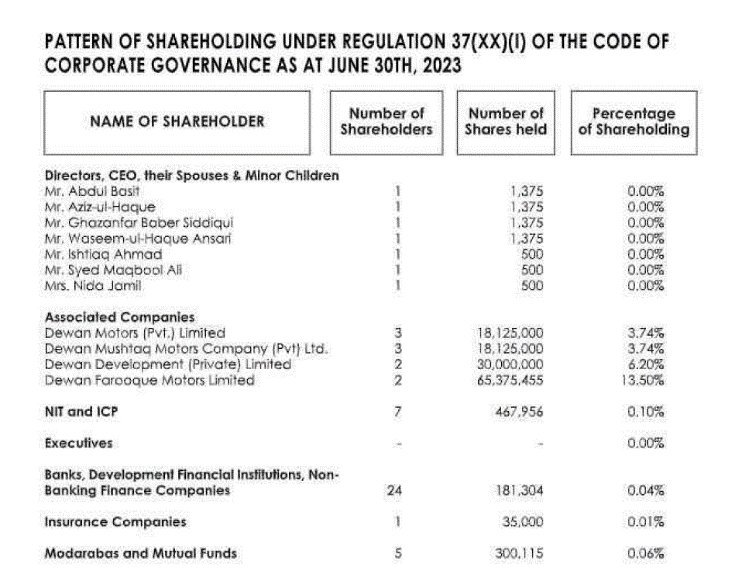

On the right is the shareholding pattern of Dewan Cement Limited taken from FY2023 annual report. Overall, 5 Modarabas and Mutal funds held shares of DCL which was equal to 0.06%. As of July 2023, none of the Modarabas or Mutual funds held shares of DCL.

Strength and Weakness

Strengths:

- Strategic locations of its 2 plants makes it easy for it to export to markets like Afghanistan, India from Punjab side. While Sri Lanka and Africa from Karachi Side.

- Maintains adequate dehydration of gypsum

- Maintains better particle size distribution.

Weaknesses:

- Total debt has been increasing for the past 5 years.

- There is going concern regarding current liabilities being more than current assets as pointed out by the auditors in the Annual report.

- Last dividend paid was in 2006. No dividend has been paid after that.

Summary

Based on the above analysis it’s not recommended to invest in Dewan Cement Limited due to several factors. It has a negative interest coverage ratio which means that the company is burdened by debt expenses. Its current ratio is also less, meaning that the company does not have enough current assets to cover its current financial obligations. Dewan Cements shareholders have been losing on their investment in the company in the last 5 years as the ROE has been negative consistently. Additionally, its net margins are low as well. In contrast, there are many other cement companies like KOHC, PIOC or MLCF that have much favorable fundamentals and growth rates which would prove to be more attractive investments.