Atlas Battery Limited Report for Fiscal Year 2023

This report offers a detailed snapshot of the macroeconomic conditions, industry and company highlights of ATBA

Disclaimer: The article below is the work of a participant of Fundamentals of Capital Market training.Sarmaaya.pk holds no liability for the recommendation mentioned.

Atlas Battery Limited (ATBA) is a Pakistani manufacturing and sales company specializing in automotive, motorcycle, and other types of batteries. It is listed within the the Automobile Parts & Accessories sectorof the Pakistan Stock Exchange (PSX).

This report offers a comprehensive analysis of ATBA, including its current financial standing. The analysis encompasses an overview of the Pakistani market landscape, a detailed examination of ATBA's business operations, and in-depth financial, business, and management assessments. By thoroughly evaluating these factors, this report aims to equip investors with a holistic understanding of ATBA's market position and its potential attractiveness as an investment opportunity.

In a Nutshell

Analyst Background:

TThis research is conducted by Muhammad Ibrahim, a participant in Fundamentals of Capital Market , Batch 7 by Ammar Yaseen. Mr. Ibrahim is a Senior district field manager in Baluchistan for a pharmaceutical health company. After 12 weeks of training, he is well-equipped to conduct any sort of research.

Macroeconomic Profile:

Oil Impact:Global oil prices are around $70-80 per barrel as of May 2024, down from $100-110 per barrel in May 2023. This is a positive for Pakistan, as lower oil prices reduce the country's import bill and inflationary pressures. Lower oil prices lead to reduced energy costs, benefiting industries and consumers. (Neutral)

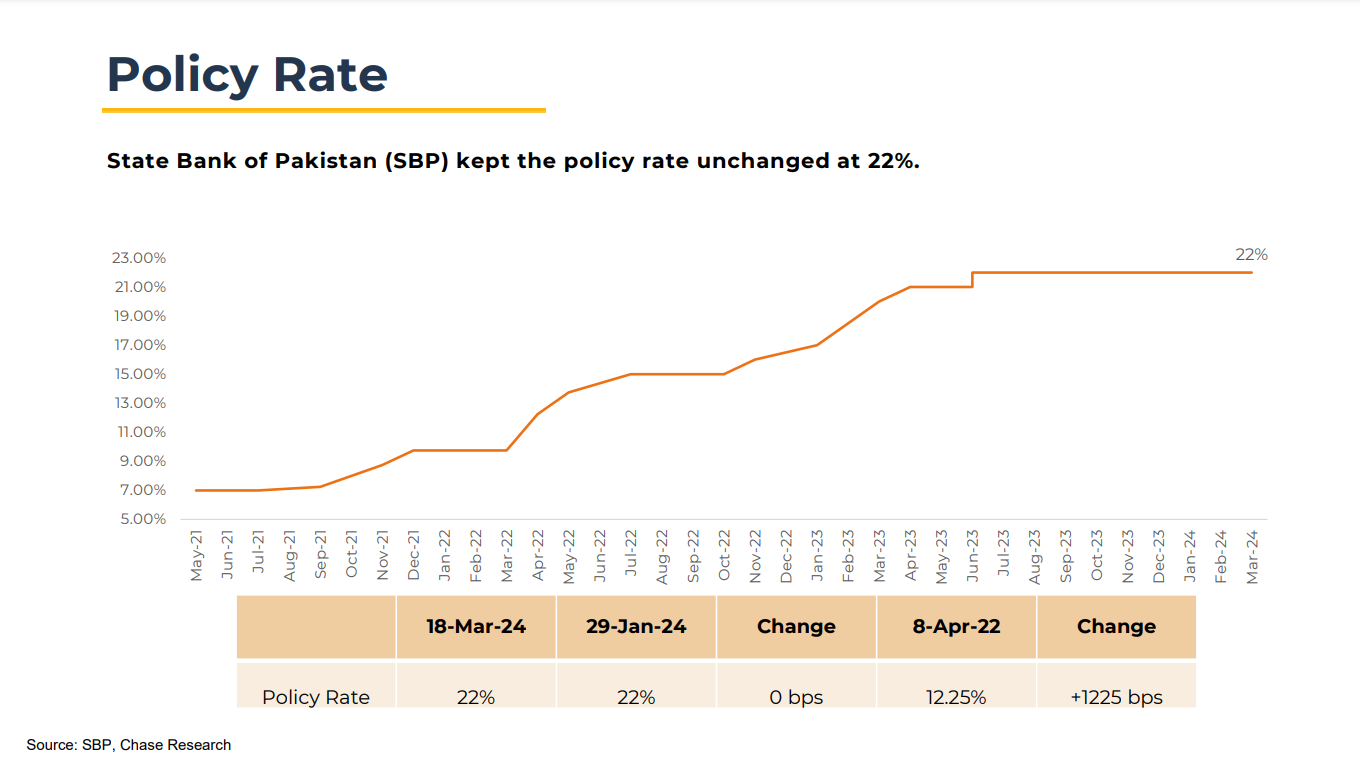

Interest Rates: The central bank has kept interest rates steady at 22% for the 7th consecutive time in March 2024. High interest rates increase borrowing costs, reduce consumer spending, and slow economic growth. High interest rates limit economic growth by increasing borrowing costs for businesses and individuals.(Negative)

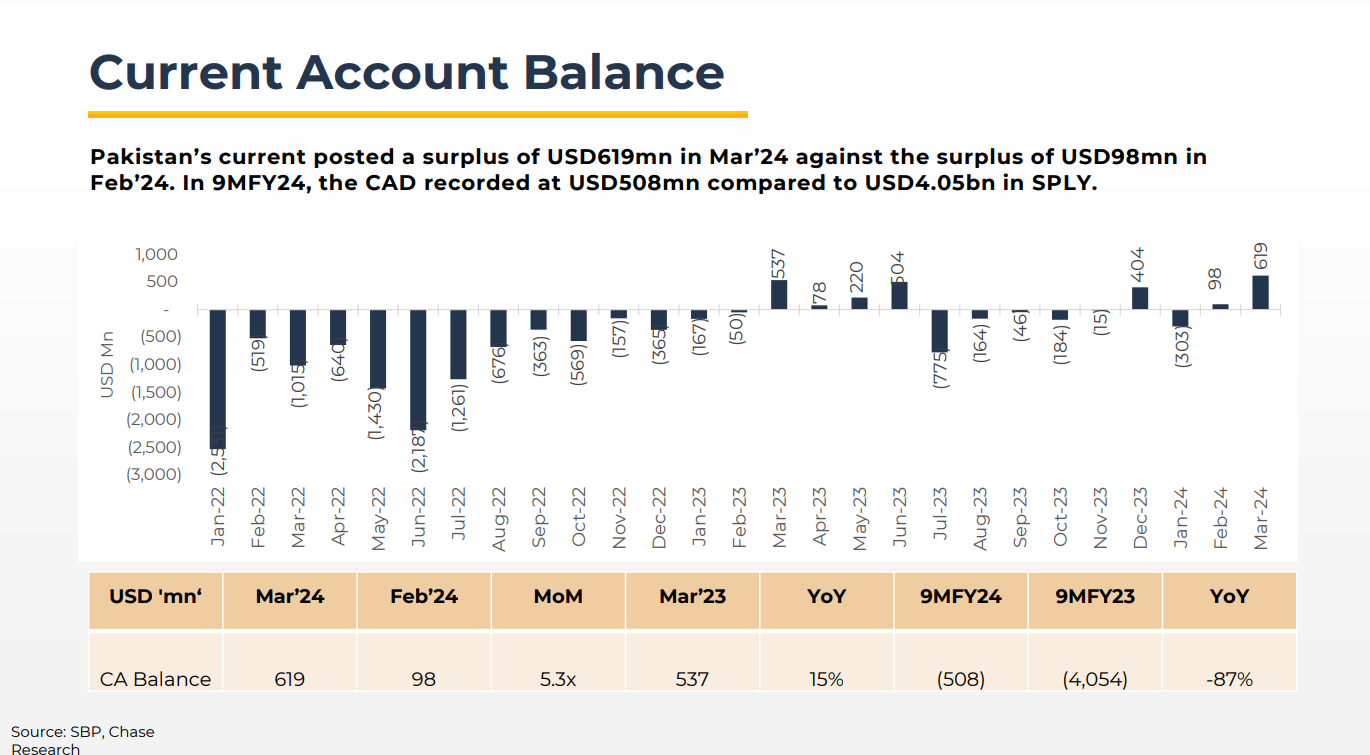

Current Account:A surplus of $619 million was recorded in March 2024, a significant improvement from last year . A current account surplus helps maintain foreign exchange reserves and reduces the country's reliance on external borrowing. A current account surplus helps stabilize the foreign exchange reserves, reducing the need for external borrowing. (Positive)

Fiscal Account:The fiscal deficit stands at around -7.70% of GDP in 2023, slightly improved from -7.90% in 2022. A high fiscal deficit indicates excessive government borrowing, which can lead to inflation and reduce economic growth. ( Negative )

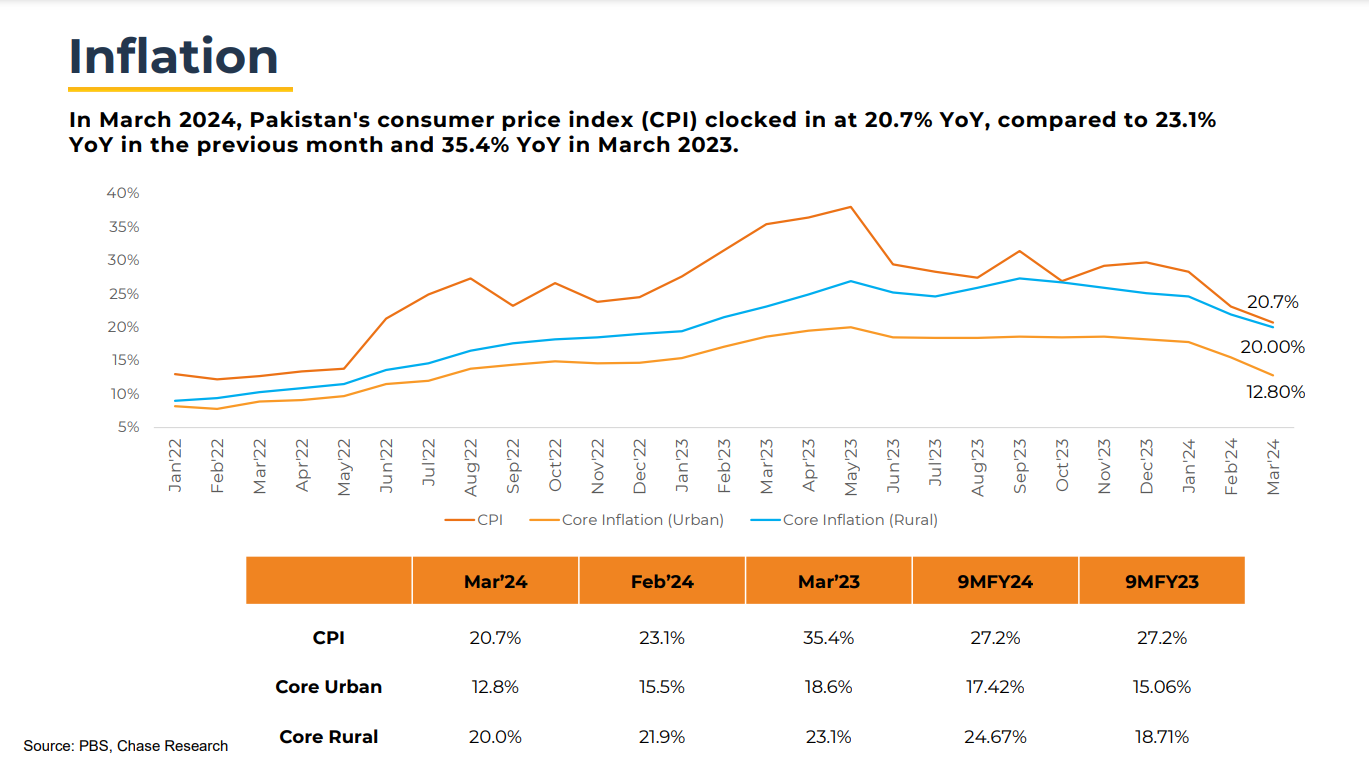

Inflation:Inflation has decreased to 20.7% in March 2024, down from 28.34% in March 2023. Lower inflation reduces the cost of living and increases purchasing power. ( Positive )

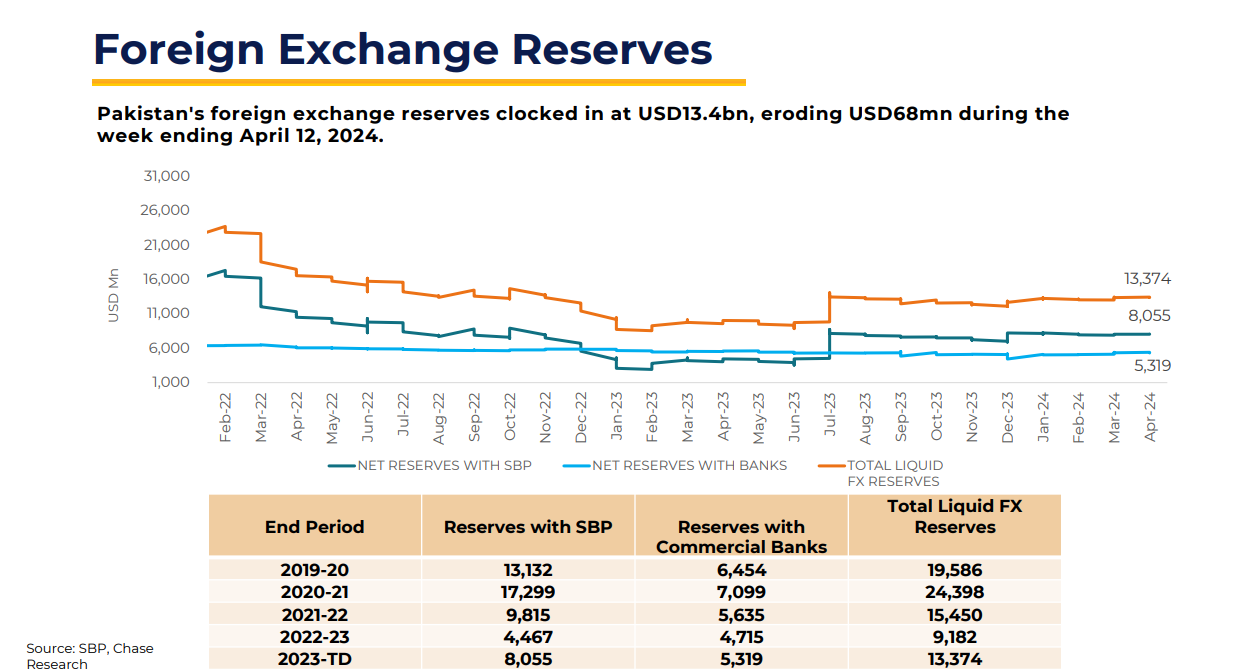

Central Bank Reserves:Foreign exchange reserves are around $13.4 billion in March 2024, slightly higher than $9.1 billion in March 2023. Sufficient foreign exchange reserves help maintain economic stability and reduce the risk of a currency crisis.(Positive)

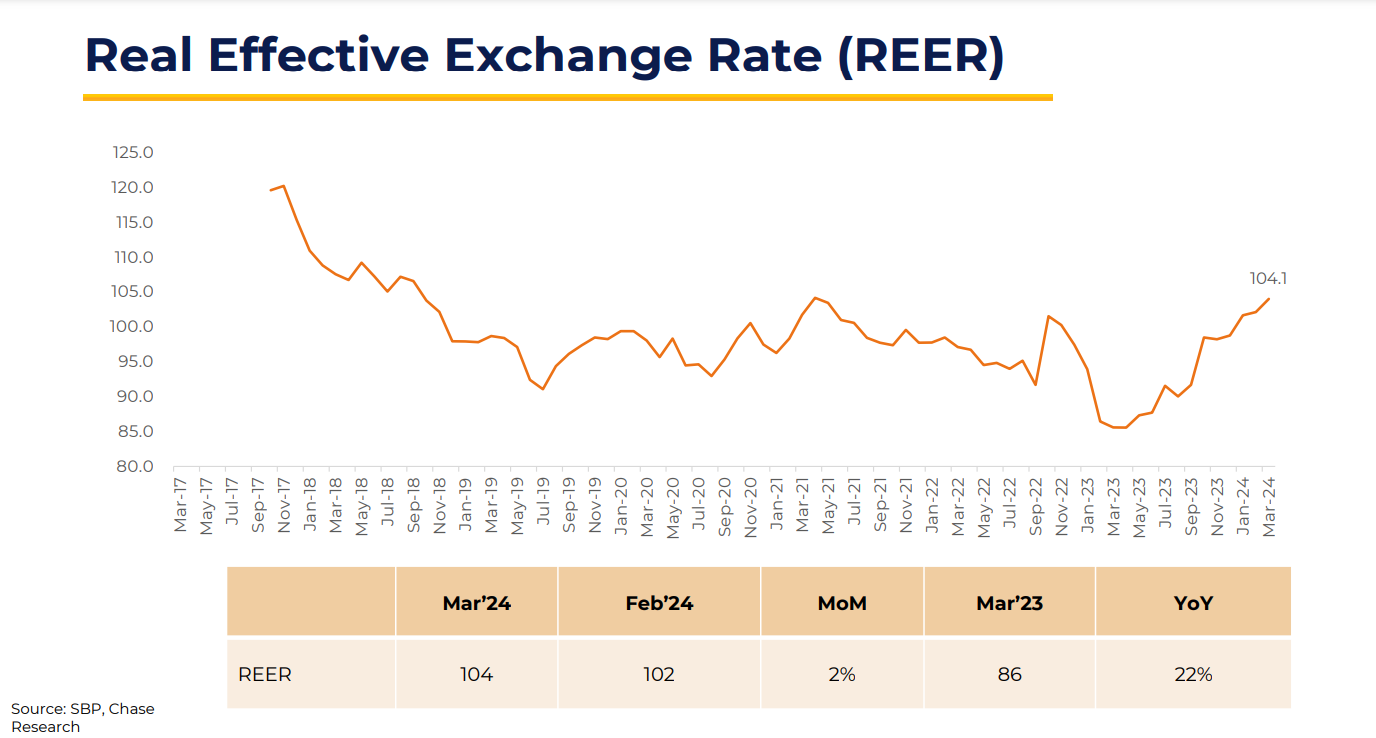

Real Effective Exchange Rate (REER): The REER stands at 104 in 2024, higher than 96 in 2023. A high REER indicates reduced price competitiveness for Pakistani exports, potentially leading to a decline in exports and a widening trade deficit.(Negative )

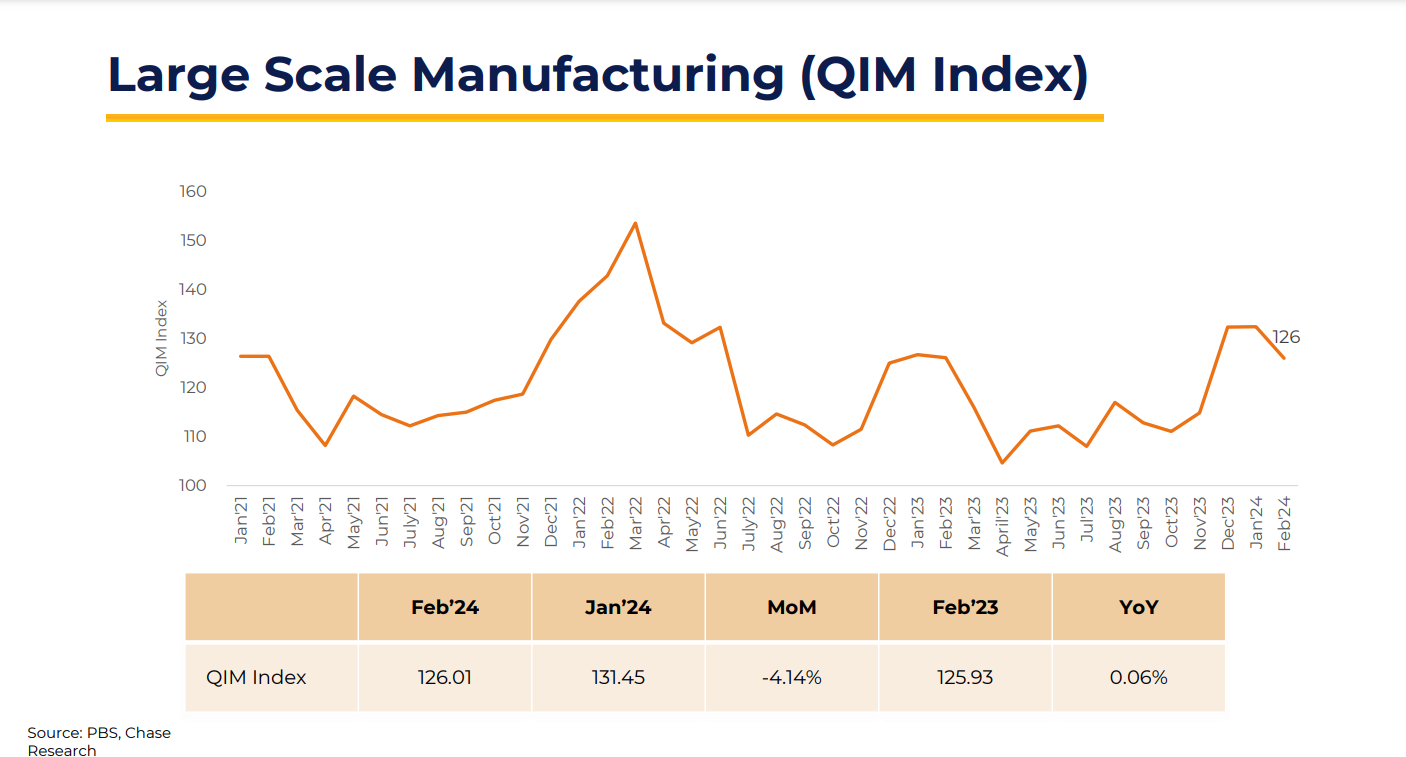

Large scale manufacturing index : It has seen a slight decline from January 2024. This indicate that there is a slow down in large-scale manufacturing sector, which can effect the country's GDP and economic growth.

Company Profile:

Atlas Battery Limited primarily sells automotive, motorcycle, and energy storage batteries, along with their allied products. The product range varies from conventional batteries to innovative low maintenance hybrid, maintenance free and deep cycle batteries. Today AGS is the nation’s preferred choice not only for automotives and motorcycles but also for genset, construction equipment, uninterrupted power supply (UPS) equipment and solar panels. The company signed a technical collaboration agreement with Japan storage battery co. Ltd., Japan in 1969 ( now known as GS Yuasa Corporation) for the production and sale of Japanese quality batteries in Pakistan. The company started production in 1969 with the genesis of the brand “AGS”. “A” for Atlas and “GS” for Genzo Shimadzu (the founder of Japan Storage Battery Co. Ltd., Japan). Product line up

Financial Analysis:

Growth Factors:

The company is struggling in maintaining steady growth, despite a notable Compound Annual Growth Rate (CAGR) in revenue. From 2019 to 2023, revenue surged from 12.77 billion to 41.86 billion. While operating profit has shown improvement since 2019, it remains relatively very low compared to revenue, indicating a concerning margin. Similarly, although net income has seen some improvement since 2019, it still lags significantly behind revenue mainly due to the higher consumer price index (CPI) and inflation in Pakistan. However, the earnings per share (EPS), has shown a positive trend.

Stability Factors:

- The operating margin for 2023 is unavailable, so I'll reference 2020, which, at 1.63 The net margin for 2023, at 5.36%. The company not only faces challenges in increasing its sales but also struggles to maintain satisfactory margins on those sales. This issue is particularly concerning for investors.

- The company is currently paying a corporate tax rate of 40.48.

- However, it expects that this higher rate will prove beneficial in the future.

- The interest coverage ratio stands at 7.70. However, the total debt surged from $2.49 billion in 2019 to $12.04 billion in 2023, indicating a concerning trend. Unfortunately, the debt-to-equity ratio is 1.6, presenting challenges for the company. If the debt-to-equity ratio had been less the situation would have been favorable, and the total debt would have been less concerning.

- The current ratio is 1.39, which is average.

- Cash flow from operations is decreasing, which is bad for the company.

- The sum of profit after tax is 2.87 billion, exceeding the cash flow from operations, which stands at 121.8 million.

- Return on Equity is 30.35%, which is good.

- The Net Fixed Asset turnover is categorized as good.

- Despite the company's strong Return on Equity and positive net change in cash, several stability factors raise concerns. These include declining cash flow from operations, a high corporate tax rate, escalating total debt, and a concerning debt-to-equity ratio. Maintaining satisfactory margins on sales also poses a challenge, impacting investor confidence in the company's financial stability and future prospects.

Valuation Factors:

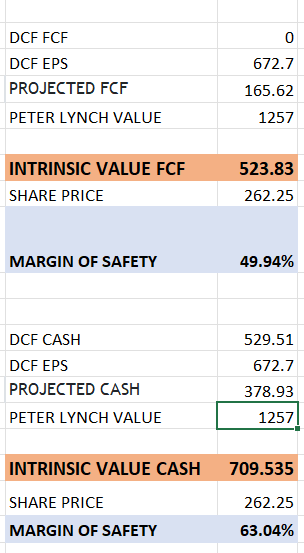

With a P/E ratio of 3.25, an earnings yield 31%, unavailable PEG ratio, PB ratio of 1.16, PS ratio of 0.17, Graham Value of 3.76, dividend yield of 11.65%, and EV/EBITDA value of 4.38, the company emerges as a highly attractive option based on valuation factors. Additionally, its intrinsic value boasts a Margin of Safety of approximately 56.49% in both FCF and cash terms, indicating potential.

Business and Management Analysis:

Business Factors:

Based on the business model of the company, the factors that effect ATBA the most are as following:

Demand for Automobiles: The demand for automobiles in Pakistan has been sluggish, with a decline of 35% in car sales in 2022-23 compared to the previous year, and a further decline of 20% in the first quarter of 2024, negatively impacting Atlas Battery Limited (ATBA)'s sales (Source: Pakistan Automotive Manufacturers Association, April 2024).

Demand for Alternative Energy: The demand for batteries for UPS and generators has increased due to frequent loadshedding, with an average demand of 1.2 million units per month in 2023, and a 15% increase in the first quarter of 2024, providing a silver lining for ATBA (Source: Pakistan Energy Ministry, March 2024).

Political stability: It remains a challenge for Pakistan's economy, which has had a ripple effect on the stock market. In 2023, the Pakistan Stock Exchange (PSX) experienced a significant downturn, but it made a remarkable recovery in April 2024, reaching an all-time high. Despite this upswing, the market still presents a buying opportunity, as stock prices have not yet reached their average price-to-earnings ratio for 2024. This limitation is, in turn, impacting the stock performance of Atlas Battery Limited (ATBA).

Plant Operations: ATBA's plants are operating at an efficiency rate of 85%, with a production capacity of 2.5 million units per month, which is a positive sign for the company (Source: ATBA's Quarterly Report, January-March 2024).

Economic Trends: Pakistan's economy is experiencing a contractionary phase, with GDP growth rate slowing down to 2% in 2022-23, and inflation rising to 35.4% in March 2023, and further increasing to 38.2% in March 2024, negatively impacting ATBA's sales and revenue (Source: Pakistan Bureau of Statistics, April 2024).

Exchange Rate Fluctuations: The Pakistani rupee (PKR) has depreciated by 30% against the US dollar in the past year, and a further 10% in the first quarter of 2024, increasing the cost of imports for ATBA and negatively affecting its profitability (Source: State Bank of Pakistan, April 2024).

Raw Material Prices: The prices of lead, polypropylene, and polymion paper have increased by 25%, 18%, and 12% respectively in the past year, and a further 5%, 3%, and 2% in the first quarter of 2024, increasing ATBA's cost of production and negatively impacting its profit margins (Source: London Metal Exchange, April 2024).

Management Factors:

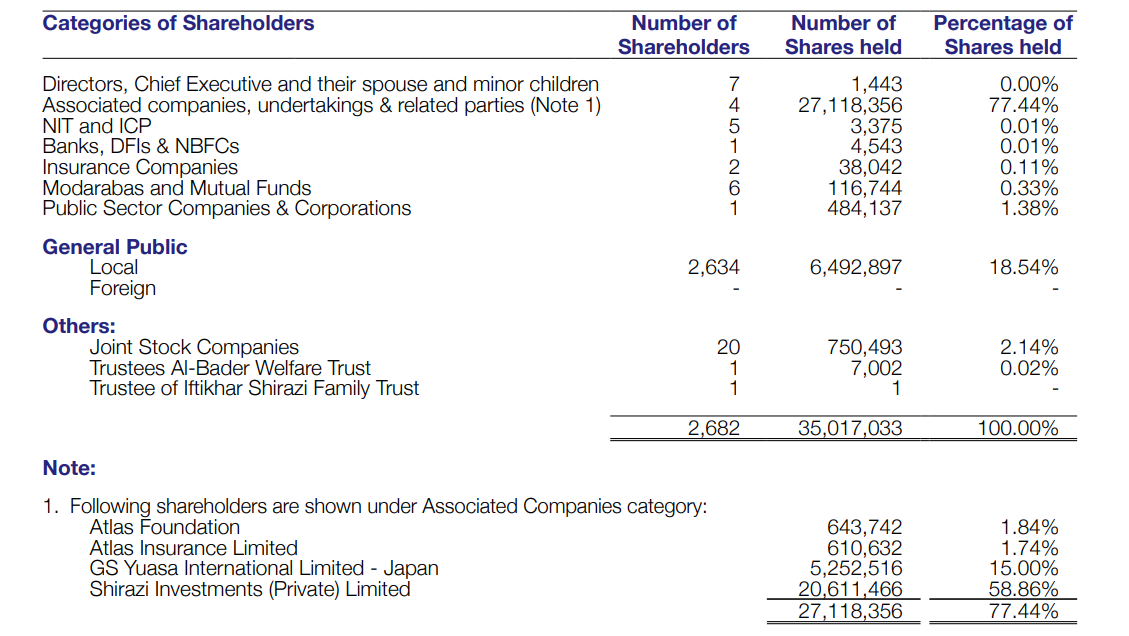

The majority of Atlas Battery Limited's shares are held by associated companies, undertakings, and related parties, including:

Atlas Foundation (1.84%).

Atlas Insurance Limited (1.74%).

GS Yuasa International Limited, Japan (15%).

Shirazi Investments (Private) Limited (58.86%).

These entities collectively own 77.44% of the company's total shares.

No mutual funds have invested in Atlas Battery Limited, either currently or in the past.

The company's dividend yield has been inconsistent over the years.

Strength and Weakness

Summary

Based on the analysis ATBA may not be a favorable investment option due to several concerning factors. Their sales growth has been average over the last five years, indicating limited expansion opportunities. Additionally, their net margins are low, and there is a noticeable buildup of inventory, suggesting potential challenges in managing operational efficiency. Moreover, the company's heavy reliance on the automobile sector, which has experienced stagnant growth, poses further risks to its revenue streams. In contrast, BWHL emerges as a more promising alternative within the same sector, boasting superior fundamentals, stronger growth rates, and healthier margins. Therefore, considering the challenges facing ATBA and the favorable prospects of BWHL, investors may find BWHL to be a more attractive investment opportunity.

- Strengths:

Weaknesses:

- Financial Support: Atlas Battery Limited receives financial support from the Atlas Group.

- Market Leadership: Atlas Battery Limited is the leading battery manufacturer in Pakistan, with a market share of around 40% (Source: Pakistan Today).

- Technical Collaboration:The Company has a partnership with a Japanese company, having signed a technical collaboration agreement with Japan Storage Battery Co. Ltd.

- High Dependence on Few Customers The company's sales revenue is concentrated among a few key customers, with the top five customers accounting for 55% of total sales. This high dependence on a few customers poses a significant risk, as the loss of one or more of these customers could have a substantial impact on the company's revenue and profitability.

- Increasing Competition and Market Share Decline The company faces intense competition in the automotive battery market, and its market share has declined from 44% in 2022 to 41% in 2023. This decline in market share could be a concern for investors, as it may indicate a loss of competitiveness or market positioning.

- High Debt-to-Equity RatioThe company's debt-to-equity ratio has increased to 1.34:1 in 2023, compared to 1.23:1 in 2022. This high debt-to-equity ratio may indicate a higher level of financial risk, as the company may struggle to meet its debt obligations or may have limited financial flexibility to invest in growth opportunities.